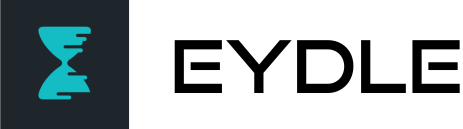

What began as a relatively obscure concept in 2008 has developed into a widely recognized financial asset. Today, cryptocurrencies like Bitcoin and Ethereum are attracting millions of investors eager to be part of the digital currency revolution.

Fig 1: Bitcoin (BTC) price per day from February 7, 2020, to July 29, 2025 (in U.S. dollars) Statista

Figure 1 shows the rapid evolution of Bitcoin’s price from February 2020 to July 2025, highlighting the growing interest in cryptocurrency over the years.

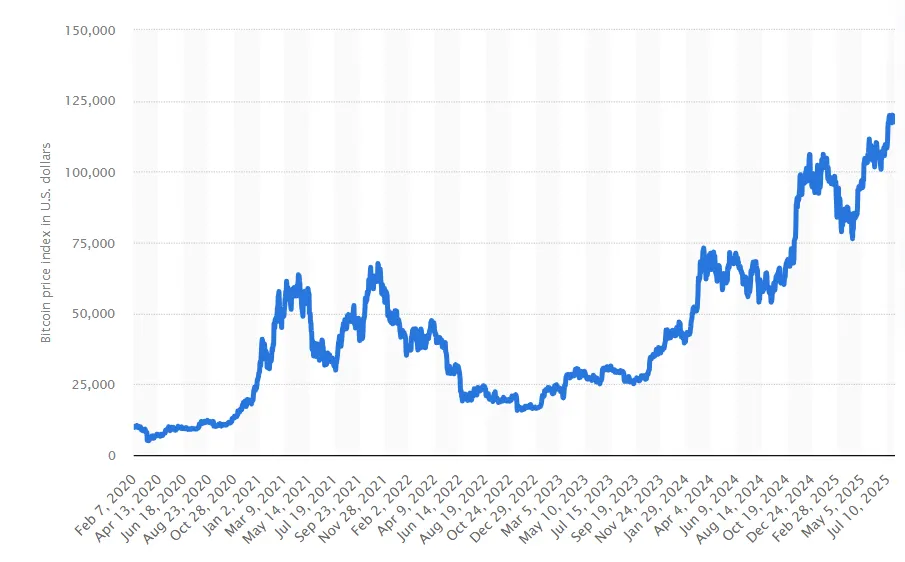

But unlike traditional assets such as stocks or money, crypto operates without formal regulation or insurance, making it a high-risk market. In 2024, crypto investment scams resulted in $ 5.8 billion in losses, representing a 47 percent increase from 2023 [1].

Fig 2: Crypto investment fraud count and losses by age group in 2024 [1]

Fig 2: Crypto investment fraud count and losses by age group in 2024 [1]

In this article, we explore how cryptocurrency investment scams operate and offer tips on how investors can protect themselves.

Cryptocurrency Investment Scam and “Pig Butchering”

Cryptocurrency definition: In a previous article, we wrote that “cryptocurrency, or crypto, is a digital currency in which transactions are verified and records are maintained by a decentralized system using cryptography, rather than by a centralized authority. In other words, cryptocurrency is a digital currency that exists only electronically and relies on encryption algorithms (blockchain) rather than centralized banks to verify transactions.”

While this structure offers more control to users and greater transparency, it also creates challenges. Transactions are irreversible, and the system is largely unregulated, making it a prime target for fraud.

How Do Crypto Investment Scams Start

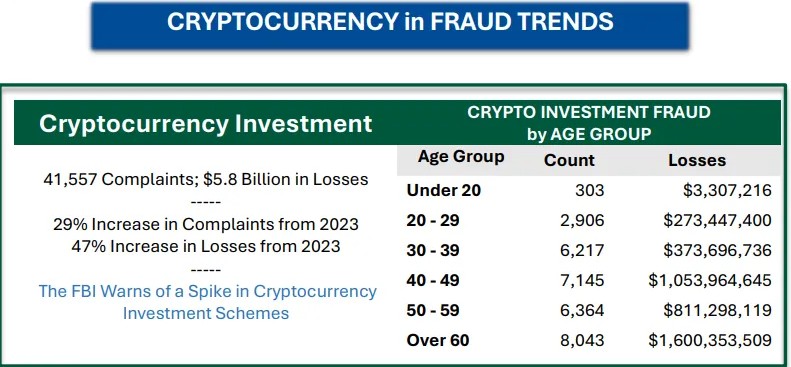

Cryptocurrency investment scams mainly use “pig butchering,” where scammers use fake profiles on online platforms to build trust with victims over time. Once trust is established, they introduce fraudulent cryptocurrency investments and persuade victims to invest.

“Pig butchering” refers to the tactic of gradually fattening up victims by building trust through prolonged contact before stealing their funds.

Fig 3: The process of cryptocurrency investment fraud [2].

Fig 3: The process of cryptocurrency investment fraud [2].

According to the FBI, a typical cryptocurrency investment fraud follows several steps [3]:

1. Scammers lure and select their victims through different methods:

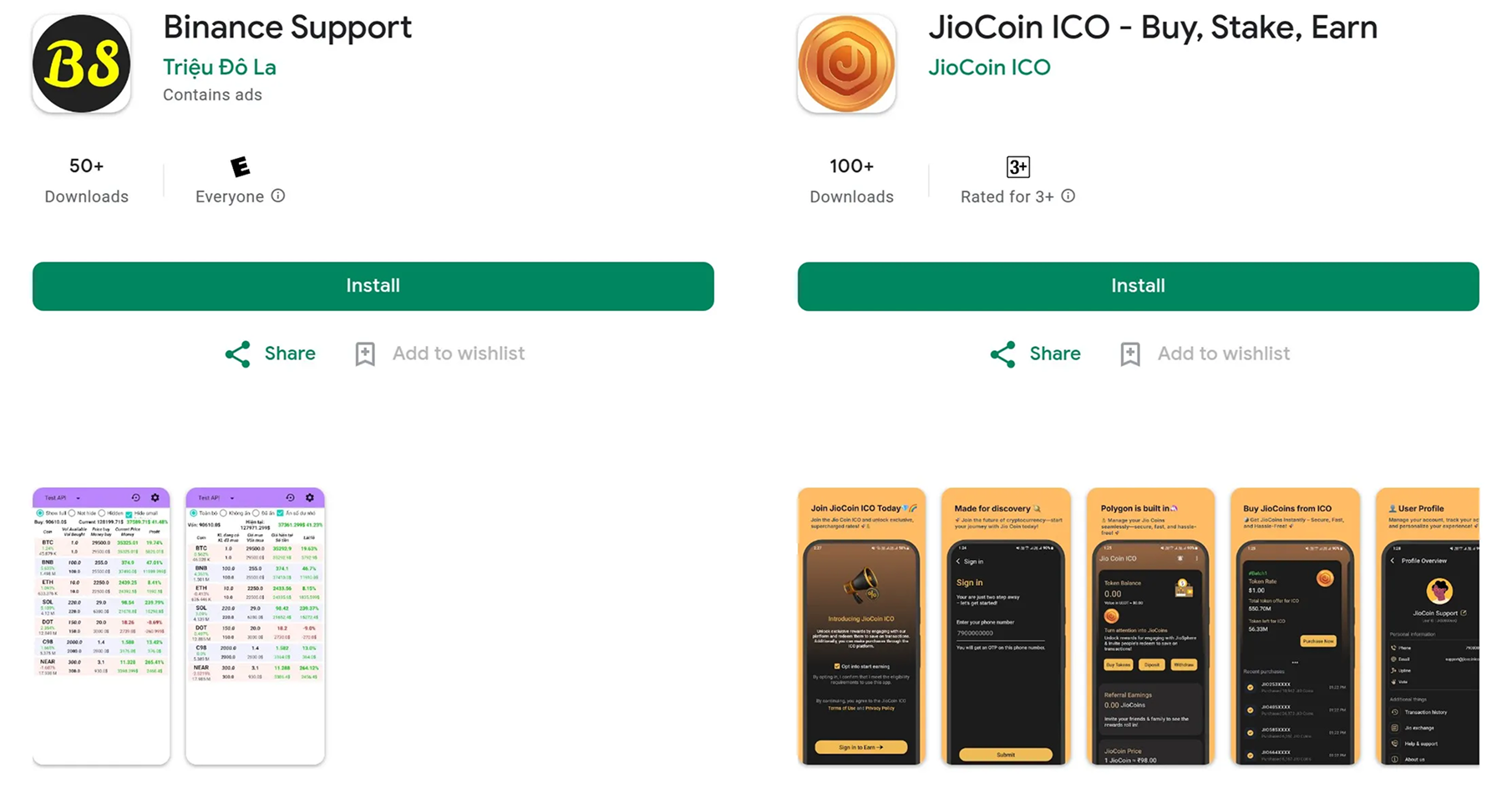

- Social Media: Scammers contact victims directly through DMs or indirectly through fake job ads or investment opportunities on social media, for example, Facebook. Often, these social media pages contain links to scammer’s website or mobile phone app that are located outside the social media platform. Figure 4 shows two scam apps on Google Playstore. JioCoin is not even a cryptocurrency but the scam app is promising an initial coin offering (ICO) via the app. If the victim installs and runs the app on their phone, their chances of getting scammed increases.

- Texting: Scammers may send messages pretending they dialed a wrong number or to offer jobs.

- Dating Sites: Scammers build fake romantic profiles and match with potential victims to gain trust and pitch investments.

2. The next step is building trust:

- Scammers use flattery and empathy, often sharing fake stories to match with the victim’s life circumstances.

- They may ask you to move to another messaging app like WhatsApp or Telegram.

- They may send selfies and pictures of themselves and express romantic interest in the victim.

- They may suggest meeting in person after money is raised, and then make excuses at the last minute.

- They would agree to do a video call but prefer to speak instead.

3. Once the scammer is sure the victim has started to trust them, they will send their investment pitch.

Scammers will claim they or an insider they know have expertise or access to promising investment opportunities. Scammers often suggest scams involve binary trading, liquidity mining, or gold futures.

4. After the scammer gains the victim’s trust, they guide them step-by-step on how to put their money into the fake investment platform:

- How to open an account on crypto exchange platforms.

- How to transfer money from the bank to new crypto accounts and convert to specific cryptocurrencies, e.g., Bitcoin, Ether.

- How to deposit crypto into fake “investment platforms” provided by the scammer, designed to look professional and legitimate (phishing websites and apps).

Fig 4: Examples of fake crypto-related apps on the Google Play Store. Binance is a cryptocurrency exchange platform, JioCoin is a blockchain-based digital reward token, and ICO stands for Initial Coin Offering.

Fig 4: Examples of fake crypto-related apps on the Google Play Store. Binance is a cryptocurrency exchange platform, JioCoin is a blockchain-based digital reward token, and ICO stands for Initial Coin Offering.

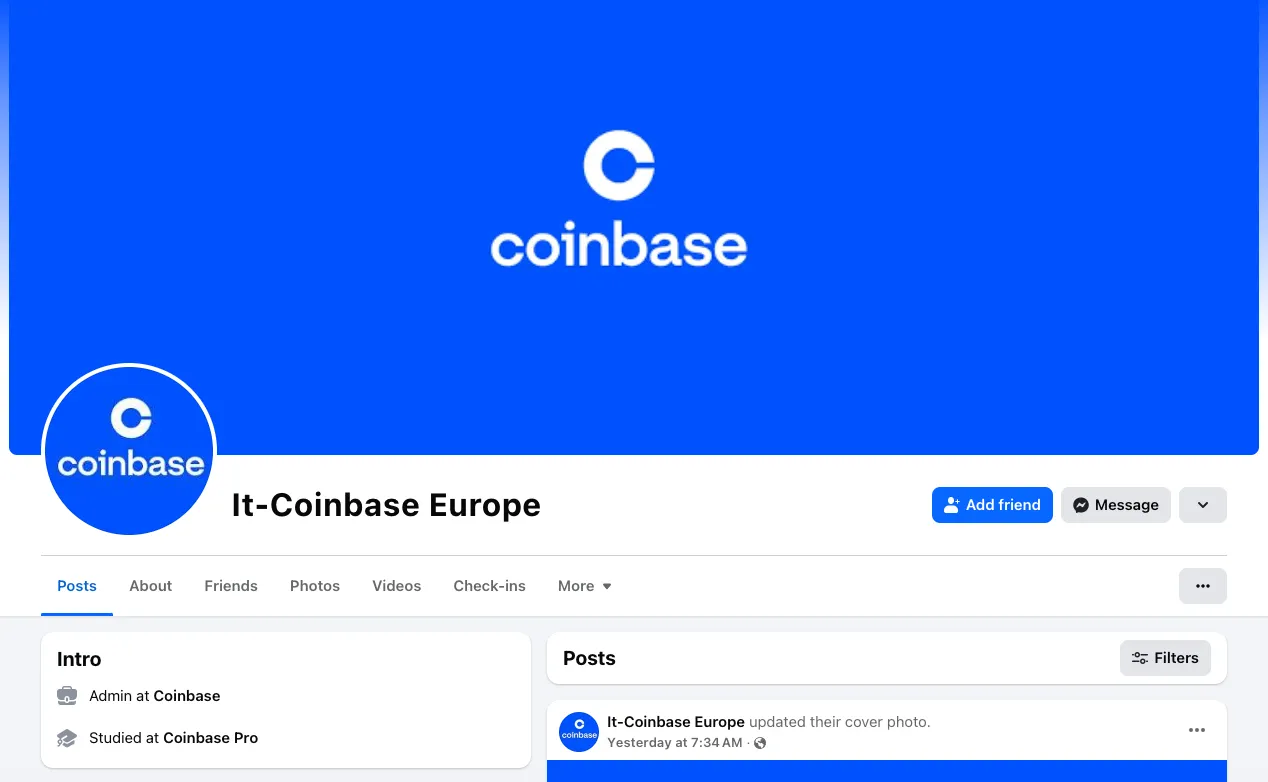

Fig 5: A Facebook page impersonating and phishing the Coinbase crypto platform

Fig 5: A Facebook page impersonating and phishing the Coinbase crypto platform

5. Getting the victim to invest more by

- Creating fake returns to make the investment look profitable and convince victims to put in more money.

- They may allow early withdrawals of supposed profits to gain the victim’s trust.

- To pressure victims further, scammers might offer to “match” funds or claim that investment opportunities are limited.

6. The Last trap

- Victims are told they must pay taxes or fees to unlock their funds, but this is just another part of the scam.

- Scammers often freeze the accounts and then disappear with all the money.

Other Crypto Investment Scams

Here are some other common investment scams that include crypto [4]:

- Fake Celebrity Endorsements: Scammers may pretend to be well-known celebrities and claim they can multiply the cryptocurrency you send them. These fake offers often come through social media and include suspicious links or QR codes.

- Investment Manager Scam: Someone might contact you out of the blue claiming to be an investment expert. They’ll promise to grow your money if you buy cryptocurrency and send it to their account through a professional-looking (phishing) website. The site and person are fake, and once your funds are sent, they are likely gone.

- Business Investment Scams: Scammers may pose as experts from reputable companies and claim to specialize in cryptocurrency investments, often promising high profits with no risk. Even if the offer appears to be backed by reviews or celebrity endorsements, it is most likely fake.

Signs of a Crypto Investment Scam

According to the Federal Trade Commission (FTC), here are common signs of a cryptocurrency investment scam [5]:

- Scammers promise guaranteed returns. They often say you’ll make big money, earn enough to quit your job, or beat the stock market, with guaranteed profits and little or no risk.

- Scammers provide little detail. If you don’t receive clear information or written proof about how the investment works, it’s a strong sign that something is wrong.

- Scammers promise secret methods or proven systems. They might say they have a special system to make fast money, but these are usually empty promises.

- Scammers use high-pressure sales tactics. They push you to act quickly to stop you from doing proper research.

How to Protect Yourself From Crypto Investment Scams

Here’s how to protect yourself from cryptocurrency investment scams:

- Research any crypto opportunity deeply before investing. Verify who is behind the investment and whether they are licensed or registered.

- Be skeptical of big returns promised with little or no risk. Legitimate investments always carry some level of risk.

- Don’t let anyone rush you into investing. Take your time to understand the offer and ask enough questions.

- Never share your private keys, passwords, or sensitive personal information.

- Use trusted cryptocurrency exchange platforms to make any investment. Beware of misspelled URLs or websites that mimic legitimate ones.

- If you suspect a scam, report it to the official authorities.

Eydle Fraud Prevention Tool

As crypto scams and online impersonation threats continue to rise, safeguarding your company’s digital presence has never been more critical.

Eydle’s AI-powered tool helps businesses protect their online presence and protect their users from fraud by detecting and taking down impersonation attacks across digital channels.

Backed by experts from MIT, Stanford, Carnegie Mellon, and leaders in cybersecurity and AI, Eydle combines advanced visual analysis with 24/7 monitoring to provide a strong, proactive defense against scammers.

Learn how Eydle can help secure your business at www.eydle.com or contact us at [email protected] to protect your brand and your users today.

Sources

- https://www.ic3.gov/AnnualReport/Reports/2024_IC3Report.pdf

- https://www.ic3.gov/PSA/2023/PSA230314

- https://www.fbi.gov/how-we-can-help-you/victim-services/national-crimes-and-victim-resources/cryptocurrency-investment-fraud

- https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-and-scams

- https://consumer.ftc.gov/articles/investment-scams