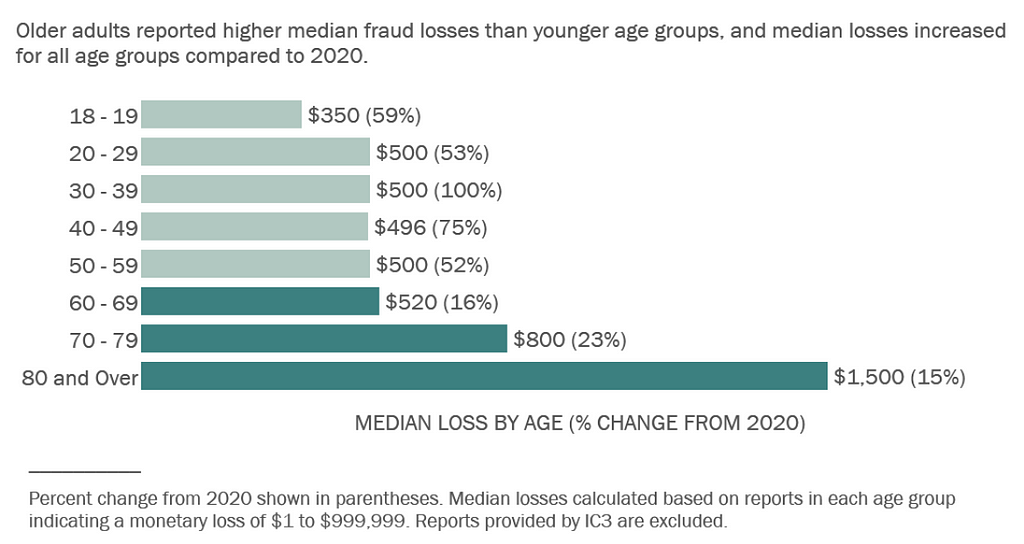

Online scams have become a common issue in today’s digital age, and older adults are not immune to their impact. According to the FTC, people over the age of 60 have a higher median monetary fraud loss than their younger counterparts (Figure 1).

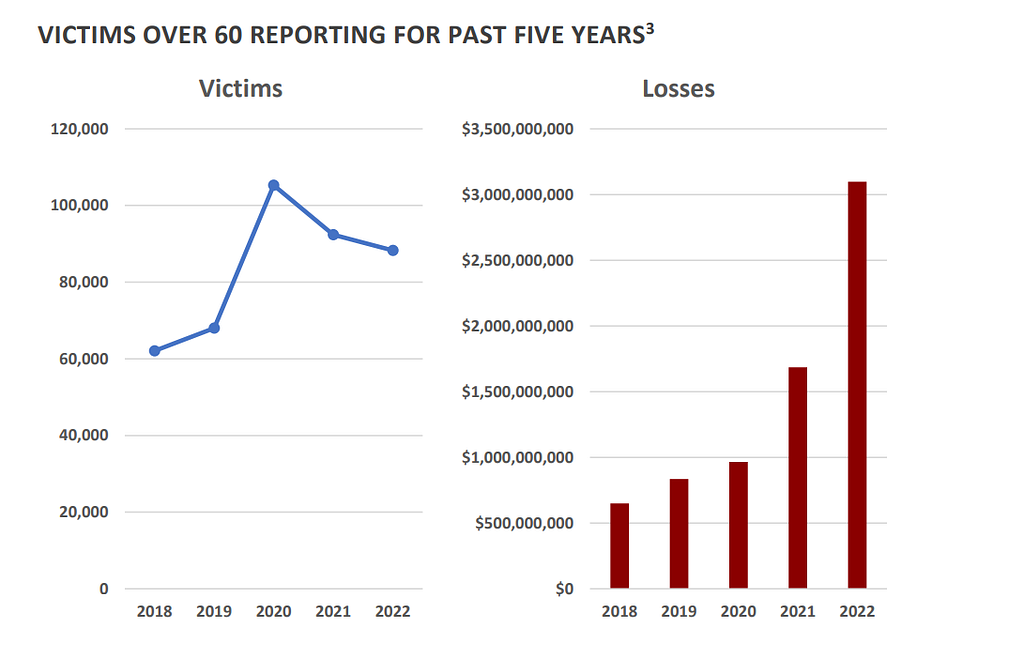

In 2020, victims over the age of 60 lost more than $3 billion to scams. This unusually high amount highlights the unique challenges and risks that older people face in today’s interconnected society. In this article, we will look at the different types of scams that target older people and provide proactive measures to protect them.

Types of scams targeting older consumers

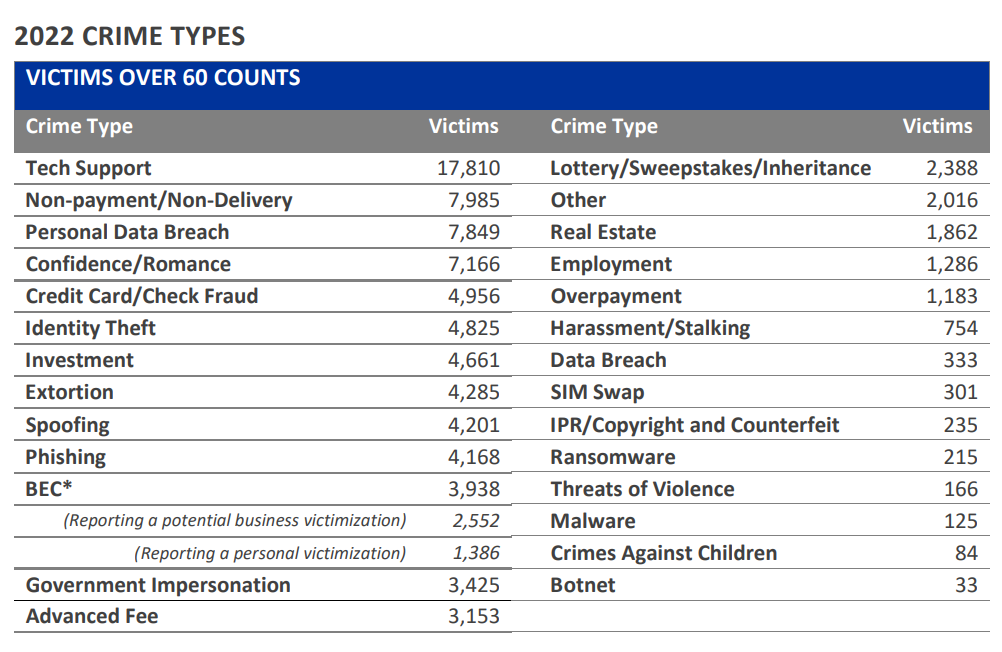

Here are some of the most common online scams that elderly people fall for [1]:

Tech Support Scams: In this type of scam, fraudsters pose as technical experts and claim to have discovered problems with the victim’s computer or software. Older people who are less familiar with technology may fall victim to these deceptive tactics, resulting in financial losses and possible identity theft.

Personal Data Breach: Scammers compromise the personal information of older adults for a variety of fraudulent activities, ranging from opening credit accounts to committing identity theft.

Romance Scams: These scams prey on the emotional vulnerability of elderly people who may seek companionship online. Scammers establish trust only to take advantage of it later for financial gain.

Credit Card Fraud: Seniors are frequently the target of unauthorized purchases, phishing emails, phone calls, and text messages, as well as fake checks that are used to steal their credit/debit card information.

Identity Theft: Identity theft involves thieves assuming an elderly person’s identity, which can lead to financial ruin and significant stress as victims try to reclaim their stolen identity.

Investment fraud: Investment fraud targets senior citizens looking for safe retirement investments by promising high returns.

Extortion: Extortion can take the form of threats or blackmail, in which scammers use sensitive information to coerce seniors into paying money.

Phishing: These attacks trick people into disclosing private information or clicking on phishing links leading to harm. Older adults may not always recognize these tactics, making them susceptible to this type of cyberattack.

Business Email Compromise (BEC) Scams: These scams target individuals in positions of authority, such as retirees managing finances or family affairs. Scammers use deceptive emails to manipulate seniors into making unauthorized financial transactions.

Why older people are more vulnerable to scams

Older consumers are more vulnerable to scams due to a number of factors [2]:

- Age-related cognitive decline can impair decision-making and the ability to successfully spot scams.

- Older adults who lack social support of family and friends, live alone, or feel lonely, are more vulnerable to con artists’ schemes, for example scams originating on social media or friend-finder websites. Also, people share their scam experiences with friends and family the absence of which means loss of such information.

- Older people lack the digital literacy necessary to understand online security procedures, for example, updating software on home computer and phone, using malware protection tools and safer passwords, activating two-factor authentication, and not sharing personal information on social media.

- Some of these security enhancing technologies are not friendly or designed with older users in mind. Usability of a new technology and its software implementation is often tested on the society’s median age population that is actively contributing or is part of the mainstream. This leaves out very young and very old people, making them vulnerable to cyber scams.

- Older customers are often retired and most of them are not a part of an organization, such as a company or a school. Most people today receive information about emerging scams and how to remain safe from their employers or schools. These organizations have incentives (legal, financial, and reputational) to protect people affiliated with them by investing in online security measures and educating the employees/students. Once retired and out of the system, a person loses on this mainstream knowledge and resources, making them more vulnerable (this is analogous to losing employer-based health insurance). The burden of keeping up-to-date with the latest technology falls on the person and increases as the years go by.

- Scammers understand that older people have accumulated wealth and savings through their past employments. This is a difference compared to the very young segment of the population who are also out of the mainstream population, because young people usually do not have wealth or signing authority. This makes older people a high-value target for the scammers.

Recognizing these factors is critical to developing strategies to keep older consumers safe from fraudulent schemes.

Protect the elderly from scams

There are several steps you can take to prevent elderly scams from affecting you or your older family members [3] [4].

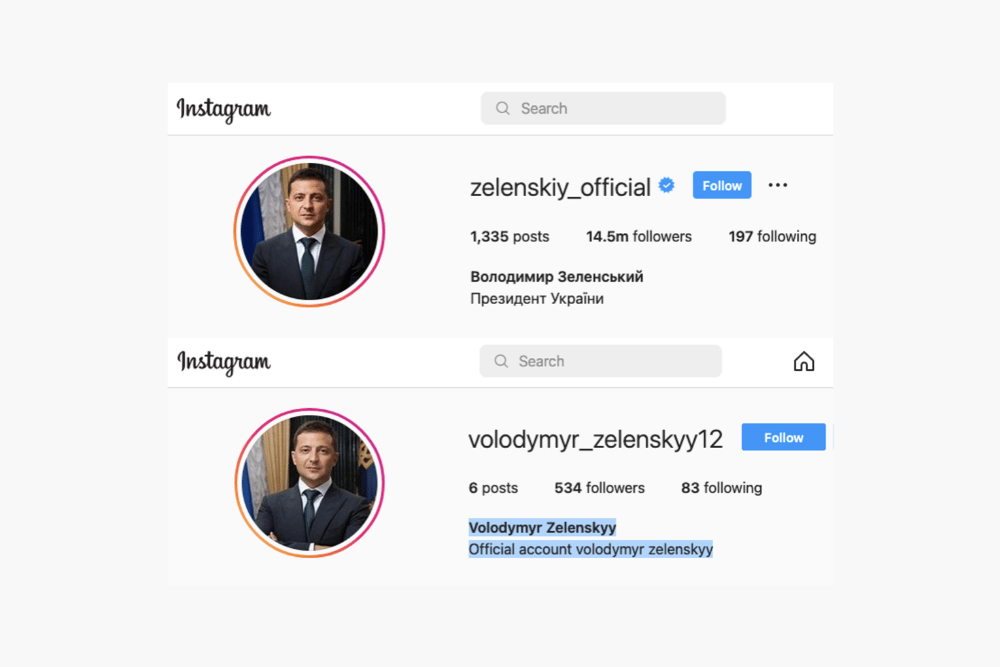

Scammers are using social media for investment, romance, and online shopping scams. More than one in four people who reported losing money to fraud from 2020–2021 said it started on social media with an ad, a post, or a message. The most money was lost to investment and romance scams. FTC

1. Stay informed: Knowledge is your first line of defense. That’s why you need to stay up-to-date on the latest scams and fraud tactics from reputable sources of information. Subscribe to reading material from reliable sources of information.

2. Be skeptical and trust your instincts. Don’t trust unsolicited phone calls, emails, messages, or DMs, especially if they request personal or financial information. Verify the identity of the person or organization requesting it and use official contact information, not details provided in the unsolicited message.

3. Secure personal information: safeguard sensitive information, such as Social Security numbers, bank account details, and passwords. Don’t share it with anyone. Use strong, unique passwords for your accounts.

4. Set up Two-Factor Authentication: Enable two-factor authentication (2FA) whenever possible to add an extra layer of security to your online accounts. Learn how to do it.

5. Monitor financial statements: Regularly review bank and credit card statements for unauthorized transactions. Report any discrepancies immediately.

6. Seek help from authorities: If you suspect a scam or fraudulent activity, report it to local law enforcement or consumer protection agencies.

7. Stay socially connected: Maintain an active social life to reduce social isolation, as scammers often target individuals who are lonely and isolated.

8. Stay cautious with online relationships: Be wary of online relationships, especially those that seem too good to be true, as they could be romance scams.

9. Educate others: Share information about common scams with friends and family to help protect them as well.

By following these steps, older individuals can significantly reduce their vulnerability to scams and protect themselves from falling victim to fraudulent schemes.

About Eydle

Eydle® Scam Protection Platform is committed to safeguarding individuals and brands from online scams and fraud. Our advanced technology, maintained by visual analysis of images and videos often used by scammers, offers robust protection against a range of threats. Backed by experts from prestigious institutions like MIT, Stanford, and Carnegie Mellon, as well as leaders in cybersecurity and AI, Eydle ensures your safety without the need for complex setups.

Whether you’re an individual seeking online protection or a brand defending its reputation, Eydle empowers you to navigate the digital world confidently.

Explore our services at www.eydle.com or contact us at [email protected] today.

Sources:

[1] https://www.ic3.gov/Media/PDF/AnnualReport/2022_IC3ElderFraudReport.pdf

[2] https://www.psychologytoday.com/intl/blog/the-high-cost-of-forgetting

[3] https://www.cbsnews.com/news/money-scams-elder-fraud-abuse/

Protecting Seniors From Scams was originally published in Eydle on Medium, where people are continuing the conversation by highlighting and responding to this story.