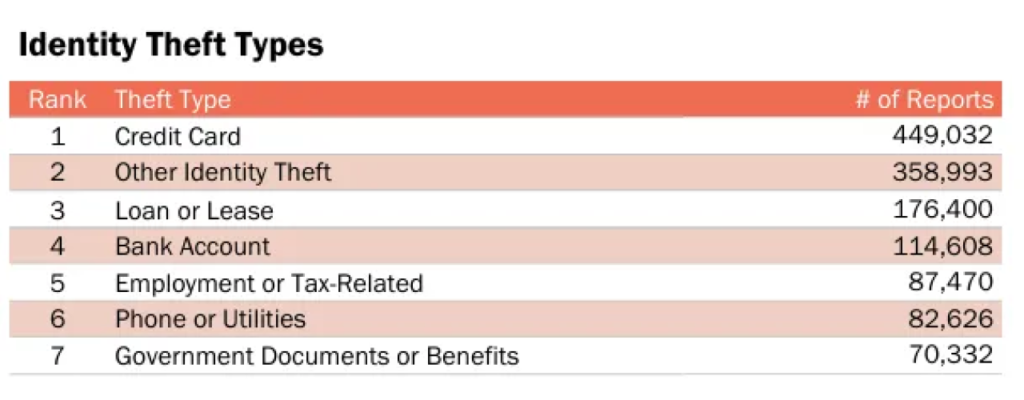

You get a random text about a $35,000 loan you never applied for. Watch out; it’s a loan scam! In 2024, loan fraud was one of the top three most reported identity theft categories to the FTC [1] (Fig 1).

Many of these scams begin with short, enticing text messages promising fast cash, low interest rates, or pre-approved loans, prompting people to act quickly and often share sensitive information or send money. Scammers rely on SMS because it is cheap to send, hard to trace, and easy to scale.

In this article, we take a closer look at loan fraud via SMS, real stories, and how to protect yourself.

SMS Loan Scams in Singapore

In 2024, Singaporeans lost $6 million through loan scams, according to the Singapore Police Force [2]. Although it is illegal for licensed moneylenders to advertise via messaging platforms, the number of cases has continued to grow over the years [3].

In one case, a man was jailed for helping unlicensed moneylenders send more than 317,000 unsolicited loan advertisement messages. He used a laptop, specialized software, and a modem pool capable of holding multiple SIM cards. The moneylenders provided pre-written messages and lists of phone numbers, which he uploaded to the software to send thousands of messages at once.

He personally sent around 173,000 messages in one session and later coordinated two others to send an additional 144,000 messages over several days. Each helper was paid up to $150 per day. Authorities raided the operation, and the individuals involved were convicted. The main operator was sentenced to two months in jail and fined $90,000, with additional prison time if the fine was not paid. His accomplices also received jail terms and fines [4].

Loan Fraud Signs

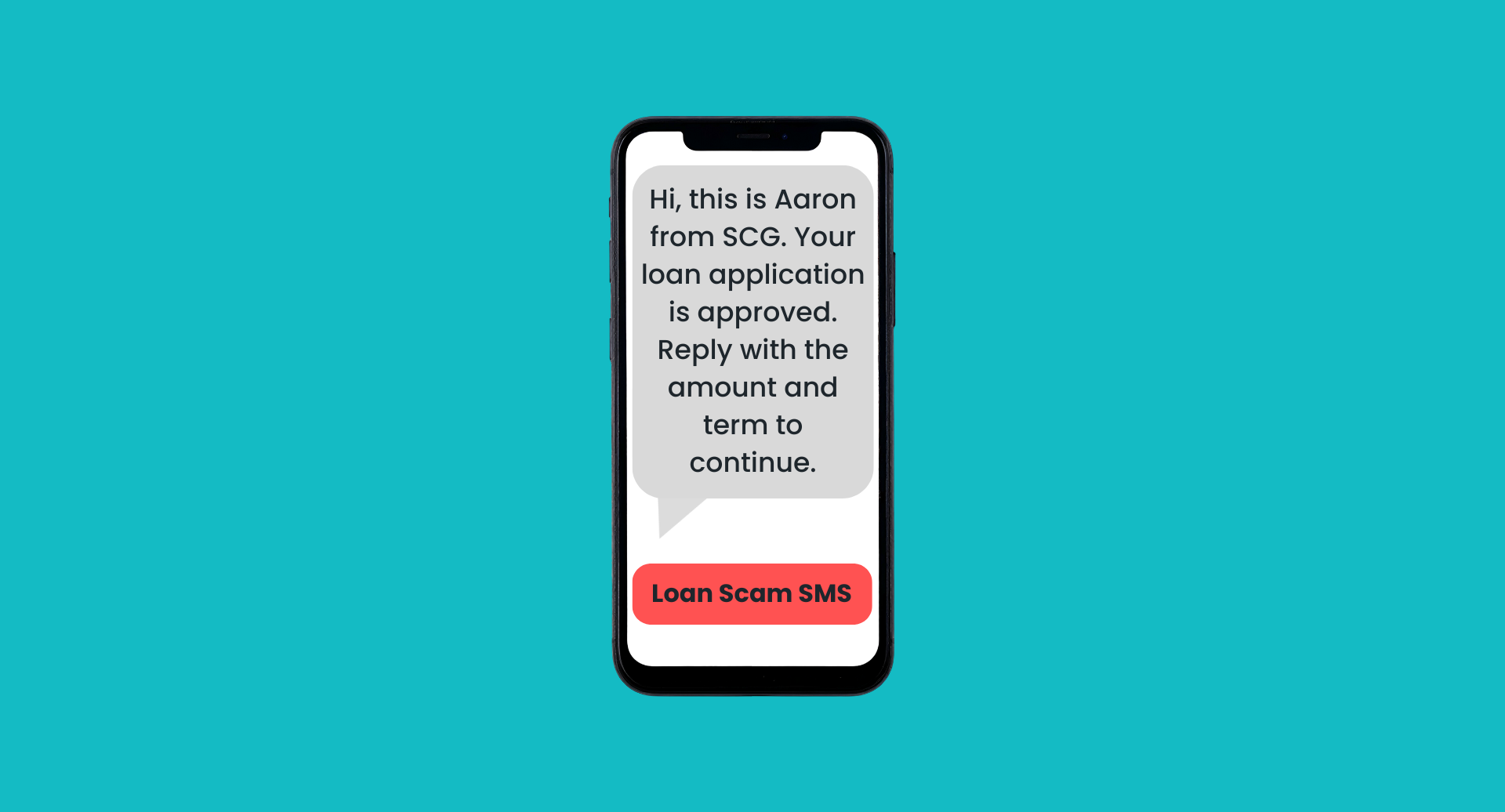

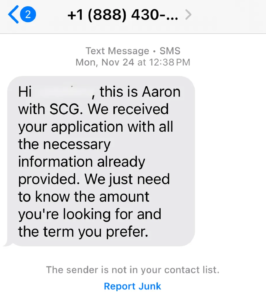

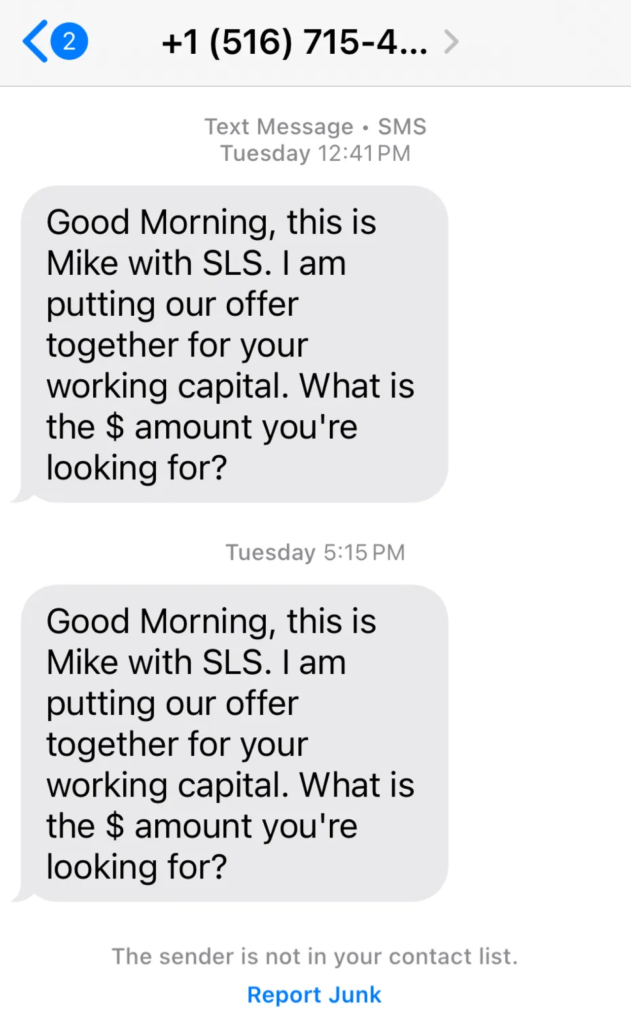

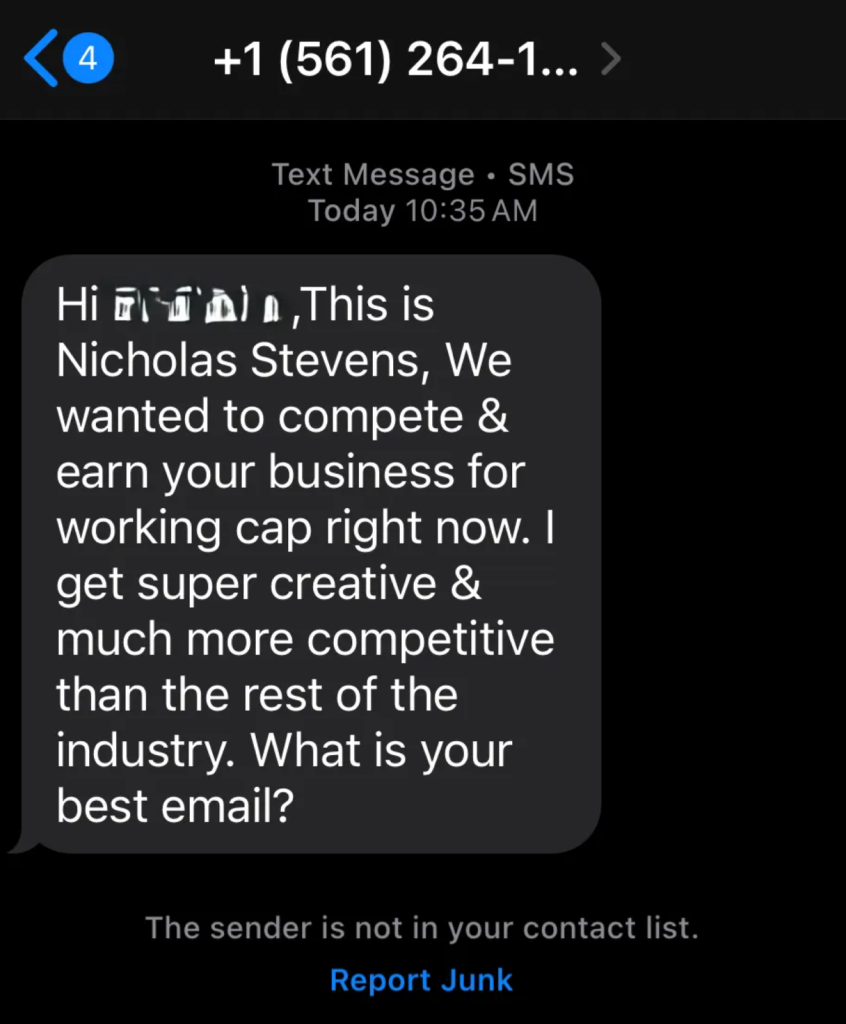

Scam messages often claim a loan can be issued instantly with low interest rates, no credit checks, or guaranteed approval, even though the recipient never applied. Here are some examples of loan SMS scams:

This message falsely presents itself as coming from a legitimate loan provider. The recipient received the SMS despite never applying for a loan on the company’s website, which is a strong indicator of fraud. Scammers often impersonate real brands to create trust and pressure victims into responding without verification.

This message initiates contact without context and asks for financial details to “start the process.” These vague openings are commonly used to draw victims into a conversation that later leads to phishing links or payment requests.

This example shows a scam message attempting to move the conversation off SMS by asking for an email address. This tactic allows scammers to continue the fraud through phishing emails, send malicious links, or request personal and financial information.

Here are the most common warning signs for an SMS loan offer [5] [6]:

- You did not apply for the loan

- The loan approval is unsolicited

- The message promises guaranteed or instant cash

- The sender asks for fees such as processing, insurance, or administration charges

- The message includes suspicious or shortened links

- The message pressures you to act now

- It asks for payment upfront before any paperwork or approval

- It requests payment through untraceable methods such as prepaid cards or cryptocurrency

- The offer comes from a source that claims to be a government agency or legal authority without proof

How to Protect Yourself

Protecting yourself from SMS loan scams starts with awareness and careful decision-making. Follow these steps to protect yourself from SMS loan scams:

- Ignore unsolicited loan offers: Legitimate lenders do not send random text messages offering loans. If you receive a loan offer you did not apply for, do not reply, click links, or continue the conversation.

- Do not pay upfront fees: Real lenders do not ask for processing fees, insurance payments, or verification charges before approving or releasing a loan. Any request for money upfront is a strong warning sign of a scam.

- Verify the lender independently: If a message claims to be from a bank or financial institution, contact the organization directly using official phone numbers or websites. Do not use the contact details provided in the text message.

- Avoid clicking links in messages: Scam texts often include shortened or unfamiliar links that can lead to fake websites or steal personal information. Avoid clicking any links sent through unsolicited messages.

- Watch for pressure and urgency: Scammers often create urgency by saying the offer is limited or requires immediate action. Legitimate lenders allow time for review and do not rush borrowers into decisions.

- Protect your personal information: Never share identification numbers, banking details, or passwords. Once shared, this information can be used for identity theft or financial fraud.

- Report suspicious messages: Report scam messages to your local consumer protection agency or financial regulator. In the United States, scams can be reported to the Federal Trade Commission. Reporting helps prevent others from becoming victims.

Protect Your Brand Online

From SMS to DMs on social media, fraudsters are always finding new ways to reach victims and steal their money and personal data.

As scams spread across the online space, businesses need strong protection for their social channels. Eydle helps organizations detect and stop phishing across social media, websites, apps, and the dark web, using advanced AI algorithms to stop threats before they reach customers and impact your brand.

Protect your reputation and your customers from growing digital threats today with Eydle!

Learn more at www.eydle.com or contact us at [email protected].

Sources

- Consumer Sentinel Network Data Book 2024

- 2024_annual_scams_and_cybercrime_brief.pdf

- Loan Scams

- Jail for man linked to more than 317k loan advertisement SMSes for unlicensed moneylenders | The Straits Times

- 10 Signs of Personal Loan Scams You Should Know | Bankrate

- Loan Scams: How to Identify the Signs and How to Avoid Them

- Tips to Avoid Falling for Fake SMS Loan Scams — Airtel