Stay a step ahead and protect your money and data. From in-person schemes to online traps, fraudsters never take a break and are always looking for ways to empty your pocket. In this article, you’ll learn how to spot the online scams people fall for every day and how to stay one step ahead.

Top 10 Common Frauds People Still Fall For (FTC 2025 Data)

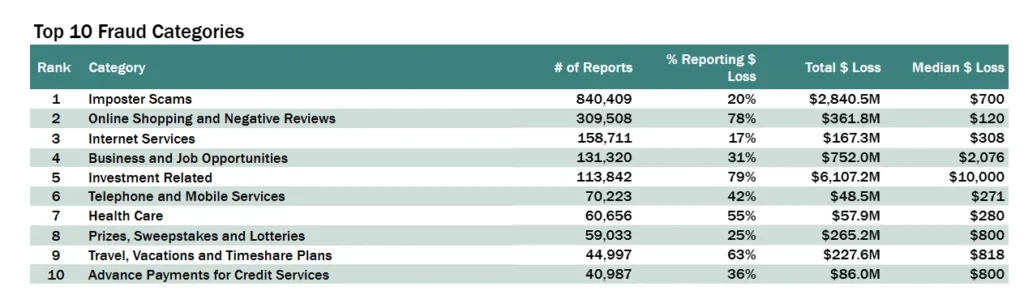

In the first three quarters of 2025, the U.S. Federal Trade Commission’s Consumer Sentinel Network received millions of reports from consumers about various scams, ranging from impersonation schemes to advance payment credit card fraud. Here’s a list of the top 10 frauds people fall for based on the number of reports [1][2]:

1. Impersonation Scams:

One of the most frequently reported fraud types involves scammers pretending to be someone you trust, such as a family member, friend, romantic partner, government official, technical support agent, or charity representative. In 2025, more than 800,000 impersonation scams were reported to the FTC, resulting in nearly $2.9 billion in losses. Scammers often create a sense of urgency by claiming an emergency. For example, they might call saying a family member has been in an accident and needs immediate money for medical expenses. Others may pose as tax authorities, threatening arrest or legal action unless the victim pays overdue taxes immediately.

2. Online Shopping and Negative Reviews:

Online shopping and negative review scams appear in different forms. Some sellers advertise low prices but quietly add extra fees at checkout, while others deliver items late, send products that don’t match the listing, or never deliver anything at all. In many cases, buyers are denied refunds or guarantees that were promised at the time of purchase.

In addition, some businesses try to block or remove honest customer reviews, creating a false impression of quality and reliability and making it harder for shoppers to spot bad sellers.

3. Internet Services Scams:

Internet service–related scams affect many online activities. Consumers often struggle to cancel an internet service provider or online account and may face problems with online payment platforms, social media services, internet gaming, or virtual reality services.

In other cases, companies add fees that were not clearly disclosed upfront. Problems are also common with broadband internet services, where the actual cost, availability, or connection speed does not match what was advertised, leaving consumers paying more for lower-quality service.

4. Business and Job Opportunity Scams:

Scammers often take advantage of people who are eager to find a job, especially those looking for flexible or work-from-home opportunities. These scams commonly appear as fake job listings, franchise offers, or business opportunities that promise high earnings with little effort. Victims may be asked to pay upfront fees, share personal information, or buy training, certifications, or starter kits. Common examples include reshipping jobs, reselling merchandise offers, nanny or virtual assistant positions, mystery shopper roles, and job placement services that require payment in advance.

Legitimate job opportunities will never charge you a fee to interview or consider you for a position [3]

5. Investment Scams:

Investment scams cause the largest financial losses among all scam types, exceeding $ 6 billion, even though they are not always the most frequently reported. These scams promise fast or guaranteed returns with little effort or risk, often involving cryptocurrency, financial markets, real estate, or precious metals. They commonly begin with free seminars, training sessions, or online ads, then pressure victims to pay for costly coaching, tools, or access to so-called proven systems. Scammers frequently use fake success stories, high-pressure tactics, and claims of insider knowledge to appear credible. In reality, the investments are fake or highly misrepresented, and once money is sent, scammers disappear, leaving victims with significant losses and no way to recover their funds [4]

6. Telephone and Mobile Service Scams:

Telephone and mobile service scams often involve misleading ads, unexpected fees, or services that don’t work as promised. For example, a phone plan may be advertised as unlimited or low cost, but the bill later includes extra fees or limited coverage in certain areas. Some consumers download mobile apps or services that claim to offer free features, only to find they do not work as promised or trigger hidden charges. These scams also show up as deceptive prepaid phone cards, poor or unreliable Voice over Internet Protocol call quality, and a flood of unwanted robocalls, spam texts, or unsolicited faxes.

7. Health Care-Related Fraud:

Scammers take advantage of people’s desire to improve their health to cheat them out of their money. Many dishonest companies make false promises about products or treatments, claiming they can cure multiple diseases and deliver miraculous results. These scams often rely on fake testimonials from supposed patients or doctors, money-back guarantees that are never honored, and urgent messages pushing people to act quickly. Others use scientific-sounding language or reference prestigious awards to appear credible. In reality, these claims are misleading, and the products or services often provide no real benefit and may even be harmful [5].

8. Prizes, Sweepstakes and Lotteries:

Prize, sweepstakes, and lottery scams often begin with an unexpected call, email, text message, or DM claiming you have won a valuable prize, such as cash, electronics, or even a car. The scam becomes clear when you are asked to pay fees for taxes, shipping, and processing, or to share personal or financial information to claim the prize. Once money or information is provided, the prize never arrives, and the scammer disappears [6].

9. Travel, Vacation, and Timeshare Scams:

Travel, vacation, and timeshare scams often promise “free” or low-cost trips, student travel deals, or exclusive timeshare offers. Timeshare agreements allow you to use vacation properties for a specific week each year or through a points-based system, but they usually come with high upfront costs and ongoing maintenance fees.

Many of these deals include hidden fees or misleading terms, leaving consumers with unexpected costs and commitments that don’t match the promises.

10. Advance Payments For Credit Card Services:

Advance payment credit card scams trick consumers by promising they can quickly approve a loan, issue a credit card, or rehabilitate your credit score in exchange for an advance payment. In reality, once the fee is paid, the promised service never materializes, and the consumer loses both money and time while receiving nothing in return.

How to Avoid Scams

Follow these general safety tips to protect your wallet from scams:

- Always research the company, offer, or person before giving money or personal information.

- Resist pressure to act quickly; take time to verify details and think through decisions. If the deal is too good to be true, believe your intuition.

- Never pay upfront fees for jobs, investments, loans, credit cards, or any promised service; paying first is a major red flag.

- Verify claims independently; don’t rely solely on ads, testimonials, or social media posts.

- Be cautious with phone calls, texts, emails, or DMs from unknown sources; don’t click suspicious links.

- Monitor bills and accounts for unauthorized charges or changes.

- Use call-blocking tools and security settings to reduce unwanted calls and messages.

- Avoid offers that promise guaranteed returns, quick profits, or “risk-free” results.

Protect Your Business Online with Eydle

As scams continue to evolve, businesses must stay vigilant to protect their customers. Eydle helps you stay one step ahead.

Our advanced AI detects phishing attempts across social media, websites, apps, and the dark web, stopping threats before they reach your audience. Safeguard your brand and your customers today.

Learn more at www.eydle.com or contact us at [email protected]