You get a sudden call from an agency saying you’ve won a free car. Exciting, right? All you need to do is give them your personal information, and they will send you the prize. Too early to celebrate! It’s a phone scam.

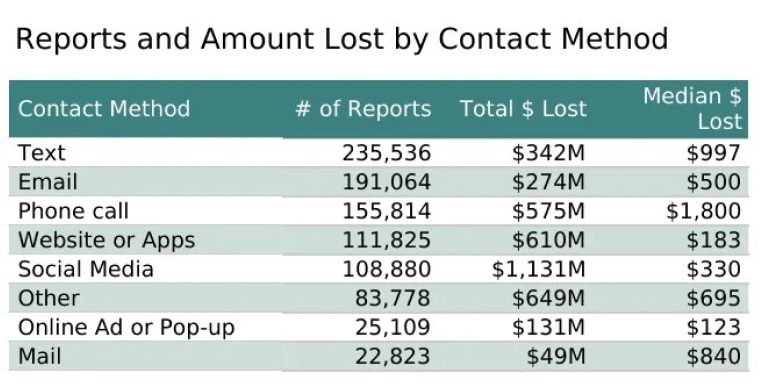

In just the first half of 2025, phone scams cost victims more than $575 million across over 155,000 cases reported to the FTC (Fig. 1).

Phone scams remain one of the most common ways fraudsters reach people. Using persuasive stories and emotional tactics, they try to trick victims into sharing personal information or sending money, often making the situation feel real or urgent.

Real Cases of Phone Scams

An 89-year-old woman from Lee County, U.S., Eileen Brice, received a call from people pretending to be Citibank employees. They warned her that there was “suspicious activity” on her account and urged her to move her money to a safe account. After following their instructions, she later realized that half of her savings was gone.

Brice contacted Citibank to explain that she believed she was following legitimate directions; the bank declined to refund her [2].

In Malaysia, a 73-year-old visually impaired retiree lost RM431,742 (approximately $102,538) to a phone scam.

The victim received a call from a suspect claiming to be an insurance company representative who informed him that he had filed a false health insurance claim and would face legal action. The call was transferred to another suspect posing as a police officer, who justified the lie by confirming the alleged involvement in money laundering.

The suspect told the victim to open a new bank account, supposedly for investigation purposes. Afraid of being jailed, the victim moved all his and his wife’s savings into the new account.

The victim’s son checked the new account and discovered that RM431,742 had been transferred by the scammer in stages from July 6 to August 14 from that new account to an unidentified account [3].

In South Korea, news that several celebrities have been tricked by voice phishing and online scams has shocked fans and raised new worries about how easily even public figures can be targeted.

Appearing on the YouTube talk show Jodongari, South Korean entertainer Ji Seok-jin shared a shocking story about a celebrity friend who lost 300 million won (around $220,000) to a voice phishing scam. “They’re a very smart person, but they were told to click a website link — and once they did, it looked completely legitimate. They’re the kind of person you’d think would never fall for it.”

Ji even admitted that he once came close to being a fraud victim. Fifteen years ago, someone pretending to be broadcaster Kim Gura tried to trick him into sending 2 million won. “I almost fell for it,” he said [4].

Common Phone Scams

Fraudsters use various tactics to scam people over the phone. Here are some common methods [5]:

Fig 2: Total losses from phone call scams by subcategory as reported to the FTC [1].

Government imposters

Scammers call pretending to be government officials such as FBI agents, IRS representatives, or police officers. They may claim you owe taxes, have missed jury duty, or are under investigation, and then demand payment or personal information to “resolve” the issue.

Business imposters

Fraudsters pretend to be from a company you know, such as a bank, utility, or online store. They trick people into giving account details or making payments.

Miscellaneous investment advice

Callers offer tips or coaching about investments like stocks or cryptocurrency. They promise big returns, but the investments are fake, and you can lose your money.

Prize, sweepstakes, and lottery scams

Scammers pretend that you have won a prize, sweepstakes, or lottery. To claim your supposed winnings, they ask you to pay a shipping or registration fee or to share personal information. Once they get your money or information, they disappear.

Tech support scams

Scammers claim there’s a problem with your phone. They may send you a link that gives them access to your device or ask you to pay in advance to “fix” the issue, but the link actually installs malicious software to control your device. They may also demand advance payments for fake processing or verification fees.

Online shopping scams

Fraudsters pretend to sell products or services online with good deals. They ask you to pay in advance or give personal information, but never deliver the items.

Romance scams

The scammer creates a fake online identity on the phone to gain the victim’s trust, then uses the illusion of a romantic relationship to manipulate the victim to send money.

Job scams and employment agencies

Scammers call you to promise high-paying jobs that require little effort, but in reality, many of these jobs do not exist at all. Scammers often pretend to hire on behalf of major companies, popular online shopping platforms, or well-known recruitment agencies. Their true goal is to steal your money and personal information.

Pyramid and multi-level marketing scams

People running a pyramid scheme call others to convince them to join by promising big profits. They may claim you can quit your job or even get rich by selling their products, but this is not true. Most of the money is made by recruiting new members, not by selling products. Pyramid schemes are structured so that participants must keep recruiting others, with most of the money flowing to the people at the top.

Vacation and travel scams

You might get a call or phone text from an agency offering cheap or free travel deals. They ask you to pay an advance fee or provide personal information. Before you book anything, remember that scammers or dishonest companies could be behind these offers.

Protect your online presence with Eydle

As the world goes digital, fraudsters aren’t stopping at fake calls or emails — they’re now using social media to steal money and personal information by impersonating trusted brands and sending deceptive DMs.

Our AI-powered tool continuously monitors your business’s social media profiles, DMs, and comments to detect phishing attempts and identity theft before they can harm your business or your customers.

Learn more about how Eydle can protect your business at www.eydle.com or reach out to us at [email protected].

Sources

- https://public.tableau.com/app/profile/federal.trade.commission

- https://dailyhodl.com/2025/09/22/89-year-old-citibank-customer-loses-half-of-her-life-savings-after-receiving-phone-call-from-scammers-and-isnt-getting-reimbursed-report/

- https://www.thestar.com.my/news/nation/2025/10/05/visually-impaired-retireee-loses-rm431742–to-phone-scam

- https://www.koreatimes.co.kr/southkorea/society/20251002/korean-celebrities-lose-millions-to-phone-scams-fueling-fears-over-rising-phishing-crimes

- https://consumer.ftc.gov/articles/phone-scams